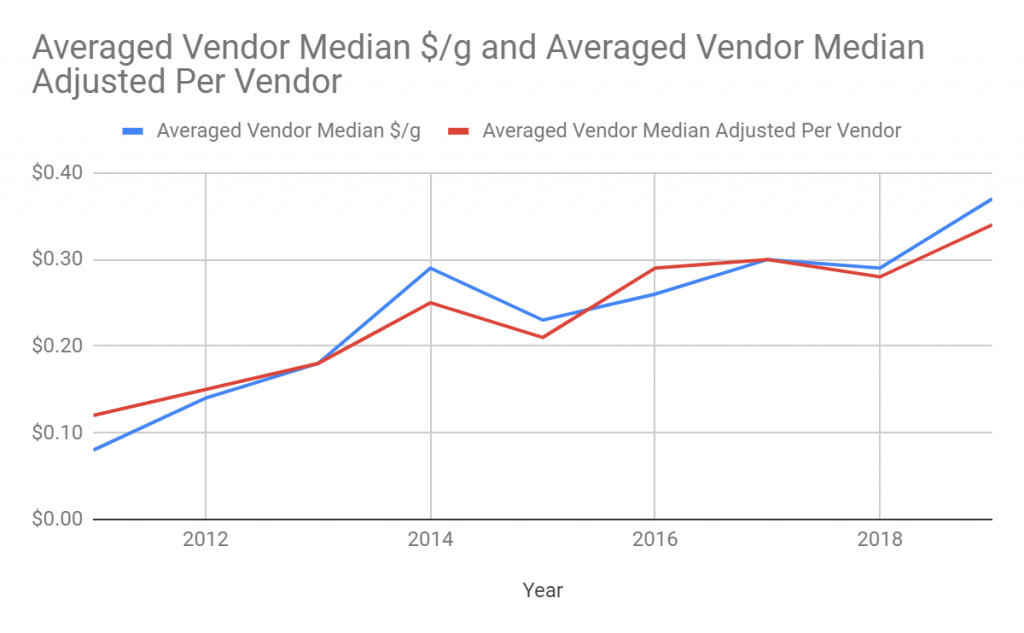

I’ve been updating a spreadsheet on pu’erh prices on release for the past few years in order to get an idea of tea being offered to western consumers and any possible trends. The well-known popular narrative is that fresh pu’erh prices have gone up and this certainly seems true in the data. Last year the prices looked about the same as the previous year. And when and how much the price has gone up depends on how we look at this and there’s a handful of different ways to look at the data and options available (I do three here).

#1 The Median Production Price Trend Over Time

The two basic methods I use to look at the median production price are:

(a) Taking the median price from all the vendors that pressed a minimum amount of teas and averaging the vendor medians together.

(b) Taking the median price from all the vendors that pressed a minimum amount of teas. Make vendor specific adjustments depending on their historical record of pressing and then average the adjusted medians together.

Using either of these approaches, the 2019 prices are the highest of the nine years we’ve tracked (anything before 2011 is guaranteed to be even lower). The price jump though can be somewhat different depending on whether we do (a) or (b). If we just take approach (a), then the price rise is around 27.5%. This is a really big price jump and the largest we see in our data since 2013-2014. However if we take the vendor adjustments (my preferred method), the price rise is a bit lower at 21.4%. Both of these are very significant leaps for a single year and the largest leaps in our data since 2015-2016.

2011-2019 Averaged Vendor Median & Adjusted Average Vendor Median

| Year | Avg Median $/g | Avg Median Adj |

| 2011 | $0.08 | $0.12 |

| 2012 | $0.14 | $0.15 |

| 2013 | $0.18 | $0.18 |

| 2014 | $0.29 | $0.25 |

| 2015 | $0.23 | $0.21 |

| 2016 | $0.26 | $0.29 |

| 2017 | $0.30 | $0.30 |

| 2018 | $0.29 | $0.28 |

| 2019 | $0.37 | $0.34 |

#2 Eye Test of Vendors Median Production

If you have a harder time conceptualizing approach #1 where we do actual calculations.. We can give the old fashioned eye test to the 2017-2019 prices of five vendors. This excludes Chawangshop, who has yet to release any tea for 2018 or 2019 spring.

2017, 2018 and 2019 Median $/g Per Vendor

| Vendor | 2017 Median $/g | 2018 Median $/g | 2019 Median $/g |

| Yunnan Sourcing | $0.19 | $0.18 | $0.24 |

| White2Tea | $0.45 | $0.45 | $0.55 |

| Crimson Lotus Tea | $0.36 | $0.34 | $0.50 |

| Bitter Leaf Teas | $0.22 | $0.17 | $0.16 |

| Tea Urchin | $0.38 | – | $0.42 |

We can easily see that four of five vendors had a more expensive median tea in 2019 than in either 2017 or 2018 which lines up with our averages from above.

#3 The Median Cake for Each Vendor

A final way to look at vendor pricing is to look at the median cake for each vendor. These days pressing 200 gram mini-bings is more the norm than throwing back the clock to 357 or 400 gram bings is and I’ve included both cake sizes.

Average 2019 Cakes by Vendor

| Vendor | # Teas | Median $/g | Average 200g Cake | Average 357g Cake |

| Yunnan Sourcing | 28 | $0.24 | $48.00 | $85.68 |

| White2Tea | 12 | $0.55 | $110.00 | $196.35 |

| Crimson Lotus Tea | 8 | $0.50 | $100.00 | $178.50 |

| Bitter Leaf Teas | 16 | $0.16 | $32.00 | $57.12 |

| Tea Urchin | 5 | $0.42 | $84.00 | $149.94 |

| Average 2019 Medians (Adj.) | $0.34 | $68.00 | $121.38 | |

| Average 2011 Medians (Adj.) | $0.12 | $24.00 | $42.84 |

My initial reaction is that young pu’erh from the western labels really isn’t cheap at all. Bitter Leaf and Yunnan Sourcing (who has always been competitive on price) offer the most inexpensive median options at $0.24/g and $0.16/g. In whole cake prices, this is $57-86/357g or a $32-48/200g cake for the cheapest vendors.

It also shows how incremental change can really add up. 10-20% price bumps for maocha each year will give you a really big price bump in under a decade. Only 8 years previously, Yunnan Sourcing’s median tea was $0.07/g!!! And while it is quite possible that business practice and/or markup explains a bit of this, it is a minor factor compared to the magnitude that production prices have risen. This bump is almost certainly due to a combination of factors but the upward trend is real.

[Added on 12/17] One plausible explanation for part of the price rise is that the western market is willing to pay higher prices for tea and vendors have responded to that by sourcing higher-priced material which may be higher quality.

Dataset

The dataset now includes Bitter Leaf Teas, who I grabbed harvest information dating back to 2016. They now have a long enough track record of making tea that I thought it’d be wise to include them. A few of the other vendors like pu-erh.sk and Essence of Tea deal in different currencies which make them more challenging, hence their omission. The data is just for spring harvest, products that are 100 grams or larger. All of the work is also visible on the shared spreadsheet. It was compiled in November 2019.

I’m not going to cover the full extent of the limitations here, but it’s important to remember what the data and scope. This is not a definitive study of price and the pu’erh market. It is a glimpse into a very minor sub-section of the pu’erh industry.

An obvious thing to remember is that this is western vendors.. Consumers exist in different socioeconomic backgrounds than vendors selling to the east do. By nature it leans towards boutique productions and there is no attempt to measure quality.

Applying This to Vendors or Productions Not Featured

One way to apply this is by seeing how vendors or individual productions compared with some of the median teas of other vendors. Take a new vendor like Tea Encounter for example.

Tea Encounter 2019 Productions

| Year | Vendor | Size | Tea | Launch Price | $/g |

| 2019 | Tea-Encounter | 357 | Baiying | $109.86 | $0.31 |

| 2019 | Tea-Encounter | 357 | Bangdong | $54.80 | $0.15 |

| 2019 | Tea-Encounter | 357 | Guafengzhai | $94.36 | $0.26 |

| 2019 | Tea-Encounter | 357 | Laos | $36.19 | $0.10 |

We can just use the eye test to see that most of the teas fall under the median price for 2019 tea. Their most expensive tea is right around the overall average, with the other three coming in under.. The averages confirm this, coming in around $0.21/g, relatively inexpensive.

Leave a Reply to James Cancel reply