Recently, a new site called Sinensis Research posted an article titled Is Pu’er a Good Investment?. It’s an interesting project looking at the price per weight of tea being sold by a number of vendors. The goal is essentially an attempt to figure out if pu’erh goes up in price over time. A couple years ago, Peter Lista looked at a similar topic in age and pu’erh prices, specifically focusing on teas sold by Yunnan Sourcing and White2Tea. Both Peter and Sinensis Research came to it from different angles and found somewhat different things. Here’s my interpretation of what they found..

Peter’s Analysis: Prices goes up over time depending on the vendor. Yunnan Sourcing’s total selection gets mildly more expensive as it gets older. Their own label has no significant relationship between price and age. White2Tea has an inverse relationship between price and age. Their more recent productions are more expensive than older teas sold on the site.

Sinensis Research: A pretty clear correlation of price and age. The older the tea is, generally the more expensive.

Omitting Boutique Pu’erh Has a Huge Impact on the Data

One interesting aspect of the Sinensis Research methodology is it omits tea from 2011-2019. This isn’t a totally unreasonable choice, but it does change the nature of the analysis significant. Young sheng is the dominant type of pu’erh in the western tea scene and by removing it from the dataset it eliminates a large amount of tea that is being sold to the western tea scene. The omitted pressings from these years would be dominated by vendor’s own labels and represent smaller runs..

Young sheng’s price tends to be very dependent on the location, the supposed quality of base material selected and the market conditions of that year. The price of maocha for the boutique productions is not always consistent and can change quite a bit year to year. While the dataset is quite large there’s all kinds of weird quirks to it that make analysis with these products messier.

Choosing teas from 2010 and earlier shows a simpler story. If 2011-2019 productions were included, I think we’d see a mild uptick in more recent prices so that more recent productions would actually be more expensive on average than say 2010-2011 products. The price young sheng is sold to westerners has gone up significantly. It’d overall show a noisier and messier picture and would make any takeaways pretty hairy.

Peter’s data does isolate boutique pu’erh. He examines both the Yunnan Sourcing label pu’erh and White2Teas. And in this, he found that YS private label had very little relationship with age and W2T had the inverse. YS raises their own label prices consistently by 15-20% per year. This data hints that the yearly price raises have basically kept pace with price bumps up in raw materials.

The Quantity Explanation

One thing that is consistent in Sinensis Research’s piece as well as Peter’s approach that looks further back (before 2011) is that older tea does indeed cost more. This is particularly true if we look at a 10-year span around 1996-2006, where Sinensis Research’s graphs show a steady increase. The teas from the earlier parts of this period are considerably more pricey on average.

It’s also interesting to see that the incline becomes much more steep and erratic in the 1999-2004 range rather than the 2004-2009 range. One inference you might make is that there is a steady price incline once pu’erh hits a certain age. When a tea hits 13 years, it will rise by ~10-20% per year.. I’m not sure how much I agree with this line of thinking.

While I do think the data is at least approximately accurate, I also believe that there’s an alternate consideration that may have a large impact on price during certain time periods.. The quantity of pu’erh being produced during certain periods during this timespan bearing a greater impact to this steep price incline.

The mid-late 1990s and early 2000s is approximately when the pu’erh industry started to boom. In Zhang Jinghong’s book Pu’er Ancient Caravans and Urban Chic she writes that in 2006 there were 80,000 tons of pu’erh produced. This is 28,000 more than the previous year 2005, an over 50% increase in one year! Meanwhile she also mentions that the 2003 definition of pu’erh mentions that production had only been 1,000-2,000 tons historically. While it’s hard to say for sure precisely how accurate these are, especially considering an elusive definition of pu’erh at the time, it does fit the conventional wisdom that production increased from 1996 onwards. With the quantity ramping up so much, I’m inclined to lean towards the explanation that older products are much higher in value because they are much more scarce and their supply is limited.

I think that these teas will continue to look like a series of steps up more expensive than the years afterwards, principally as a byproduct of production quantity stepping up by huge margins. Age undoubtedly has some impact and I do think teas will generally go up in price as they get older, but I’d argue that in the time range we’re looking at age’s impact is secondary compared with the quantity ramp up..

Quality is also obviously important. It is also not independent related to quantity. As quantity increases, the average quality of the leaf going in is generally thought to goes down. For the sake of simplicity, this is not fully explored here.

Looking at 7542 & Bumps

I think that looking at offerings sold to westerners can be useful, but there’s a few blindspots. The western market is overall very small compared with the Asian one. As an example.. One reason Sinensis Research finds that the average $/g of select factories doesn’t rise much above the average $/g, is because things like even semi-aged Dayi are rarely offered to the western market. Western outlets also tend to occupy a certain price range and may naturally sort out teas that are interesting data points but won’t sell. Scott could probably source a 2003 Gold Dayi if he wanted. But how many would pay the several thousand dollars that this costs?

A couple other quick caveats towards some of the Sinensis Research: (a) Vendor markups can be different and (b) a prolific vendor like Yunnan Sourcing sells several times the amount of tea as say Bitter Leaf Tea which can significantly skew the data if each tea is weighted the same.

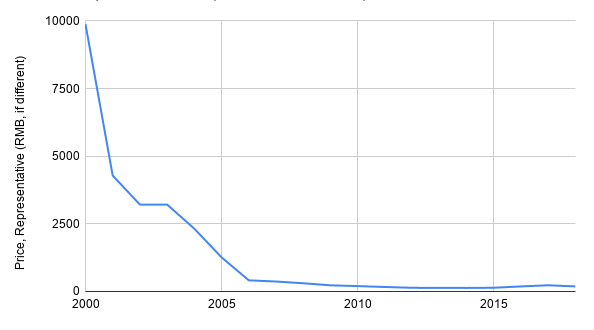

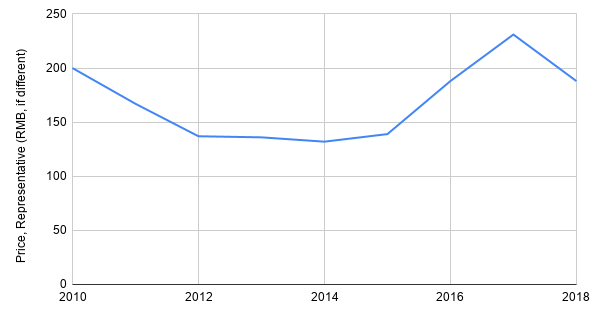

One interesting exercise is looking at Menghai Tea Factory 7542 over time. This is also imperfect and limited, but it does give us a look at a regularly made production, that has been made annually for decades. It also isn’t a boutique production and is purposefully produced in quantity intended for large consumption. In order to get the price I looked at Donghe Tea which gives a glimpse at what the market/wholesale rates of these teas are for the Chinese market.

Dayi will typically make several batches. In most years, the batches will have some minor price variation.. But in some years, there may be large price differences in unpredictable ways (504 8582 sells for significantly more than 501 8582). So I put both the first production price into a spreadsheet as well as what I judged to be a representative price of that year (if the first production price was an outlier). The results are similar, but the graph looks smoother if we choose the “more representative” price.

“Most Representative” 7542 Over Time

7542s 2010-2018, 1st Batch

7542s Over Time Table

| Date (Year) | Price, 1st Batch (RMB) | USD, 1st Batch | Price, Rep (RMB, if different) | USD, Rep |

| 18 | 188 | $26.70 | 188 | $26.70 |

| 17 | 231 | $32.81 | 231 | $32.81 |

| 16 | 188 | $26.70 | 188 | $26.70 |

| 15 | 139 | $19.74 | 139 | $19.74 |

| 14 | 132 | $18.75 | 132 | $18.75 |

| 13 | 136 | $19.32 | 136 | $19.32 |

| 12 | 137 | $19.46 | 137 | $19.46 |

| 11 | 167 | $23.72 | 167 | $23.72 |

| 10 | 200 | $28.41 | 200 | $28.41 |

| 09 | 916 | $130.11 | 229 | $32.53 |

| 08 | 305 | $43.32 | 305 | $43.32 |

| 07 | 369 | $52.41 | 369 | $52.41 |

| 06 | 786 | $111.65 | 414 | $58.81 |

| 05 | 2798 | $397.44 | 1262 | $179.26 |

| 04 | 2321 | $329.69 | 2321 | $329.69 |

| 03 | 3214 | $456.53 | 3214 | $456.53 |

| 02 | 3214 | $456.53 | 3214 | $456.53 |

| 01 | 4285 | $608.66 | 4285 | $608.66 |

| 00 | 9881 | $1,403.55 | 9881 | $1,403.55 |

| 99 | No Data | No Data | No Data | No Data |

| 98 | No Data | No Data | No Data | No Data |

| 97 | 40000 | $5,681.82 | 40000 | $5,681.82 |

Compiled in November 2019.

The Trend: Increases over Time But Also Big Bumps

The graph takes a similar shape to Sinensis Research and Peter’s graphs. Moving up and down almost randomly from 2010-2019 and then slowly rising before more significant jumps. We see a huge increase between 2004-2006. Is this due to 14 year old pu’erh being much more valuable than 13 year old pu’erh? I personally don’t think is the primary driving force and believe that this is more explained due to quantity (and the directly related quality) shifts rather than a magical price bump once a tea turns 14. If you think I’m wrong, you should buy lots of 2006 7542, before the 14 year old birthday. If we looked at a different production (i.e. 8582) or even some sort of Menghai average I believe we’d see a similar trend, with a slow 10-15% yearly increase highlighted by larger bumps in price around the 1999-2004 area just like we see for the 7542 and for Sinensis Research’s data.

Leave a Reply to RichD Cancel reply